Chipo Scolley (of Legal & General), member of the CMI Annuities Committee, reflects on the key findings of their analysis of the mortality experience of pension annuities in payment in 2023.

Chipo Scolley (of Legal & General), member of the CMI Annuities Committee, reflects on the key findings of their analysis of the mortality experience of pension annuities in payment in 2023.

The CMI Annuities Committee has recently released CMI Working Paper 198, presenting our latest annual update on mortality experience of pension annuities in payment, with the analysis focusing on 2023. In this blog, we consider whether this latest data helps us to answer the question of whether we are seeing trends emerge (signal) or still in volatile times (noise) as we emerge from the COVID-19 pandemic

Working Paper 198 represents a comprehensive analysis of the UK annuity market in 2023, based on data from 11 insurance companies, consistent with the 2022 analysis. This covers a broad range of products from internally and externally vesting individual annuities to bulk annuities. Recently (since the analysis of 2021 data in Working Paper 172) we have started including enhanced annuities in our analysis and have included buy-ins (in addition to pension buy-outs) within our bulk annuity data.

We continue to be grateful to our data contributors who provide data and make it possible for us to provide such a comprehensive analysis.

Alongside the paper, we have also published a spreadsheet containing the values underlying charts and, for the first time, these include data visualisations in the form of pivot charts so users can compare some key results.

As we continue to move on from the 2020 spike in COVID-19 related deaths, most will be feeling the need to firm up on their position regarding any continuing impact of COVID-19 on emerging experience. This is while mapping possible interactions with NHS backlogs, cost of living and geopolitical developments. All while anticipating CMI_2024. Can we find some insights for the future as data emerges or is experience still too volatile?

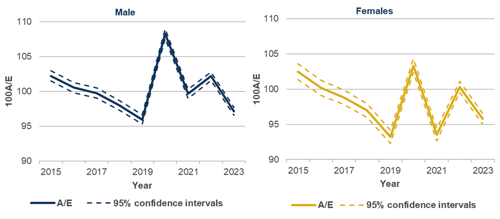

Experience by calendar year at an aggregate level for (non-enhanced) pension annuities in payment between 2015 and 2023 is shown in Chart 1. Experience between 2021 and 2023 has been volatile. At an overall level the mortality experience for 2023 (measured by comparing actual deaths with those expected under the “16” Series mortality tables for pension annuities in payment) is lower than 2022 but still above pre–pandemic levels, with interesting differences by gender.

Chart 1: 100A/Es by calendar year compared with the unprojected “16” Series tables – 2015-2023

We also note a stronger decline in deaths over summer 2023 than in 2022, by considering death volumes by month in Chart 3A in the working paper. The overall progression of the pensions in payments deaths over the year does not look too dissimilar to the population level deaths observed over 2023 for England & Wales, as seen in CMI Mortality Monitors.

Results by product type are generally consistent with previous analyses, for example, experience of individual annuities is lighter than bulk annuities, and within individual annuities experience of externally vested annuities is lighter than internally vested annuities. There is some variation in experience by age band and sex for each product type and distribution channel considered, but across the board experience over 2023 is lighter compared to 2022.

Experience by age band varies by product type. For some there is a downward shape of 100A/Es by age while for others, experience is relatively flat in the age ranges with reasonable data volumes. Although there is some variation, trends by age in 2023 do not appear dissimilar to recent years.

One factor that appears to be consistent in each analysis for annuitants is mortality experience by Index of Multiple Deprivation (IMD) and analysis of 2023 data is no exception. Those in less deprived socio-economic groups experience lighter mortality, for the annuitant dataset as a whole and for each product type analysed.

Analysis of SMRs suggest that experience has been relatively volatile year-on-year since the pandemic, with improvements higher in some years and lower in others when compared to the population of England & Wales. The analysis is vulnerable to changes in the underlying annuitant dataset and our assumptions around late reporting of deaths.

Population deaths over 2023 per the CMI Mortality Monitors were relatively high in January then fell in the summer months and increased at the end of the year. Based on death volumes by month, the aggregate pension annuitant dataset exhibited a similar pattern within the year. We know now, from CMI Mortality Monitors, that the population experience over 2024 started off lower than in 2023 and followed a similar seasonality pattern to 2023. Later this year, the Annuities Committee will turn our attention to analysis of data to 2024 and will be interested to see whether it follows the pattern in the population data. If so, it might be that the noise in previous years is starting to turn into signal.

Not all factors point in the same direction, and we haven’t yet seen a clear “new normal” in the level of mortality post-COVID. It remains to be seen whether experience by calendar year will settle into a more predictable pattern and if so what direction that pattern will follow for pension annuitants.

In addition to the annual experience updates for pension annuities in payment the Annuities Committee has several future analyses planned. This includes:

Please share any comments via email to annuities@cmilimited.co.uk.