There are four key elements to the planning process for any project, and writing a good report should be viewed as the communication of the project undertaken (covering the assumptions made, the methodology used and the results obtained) not as an extra work-stream of the project.

There are four key elements to the planning process for any project, and writing a good report should be viewed as the communication of the project undertaken (covering the assumptions made, the methodology used and the results obtained) not as an extra work-stream of the project.

Having a good infrastructure in place is critical to the effectiveness and efficiency of actuarial work. You should ask yourself the following questions:

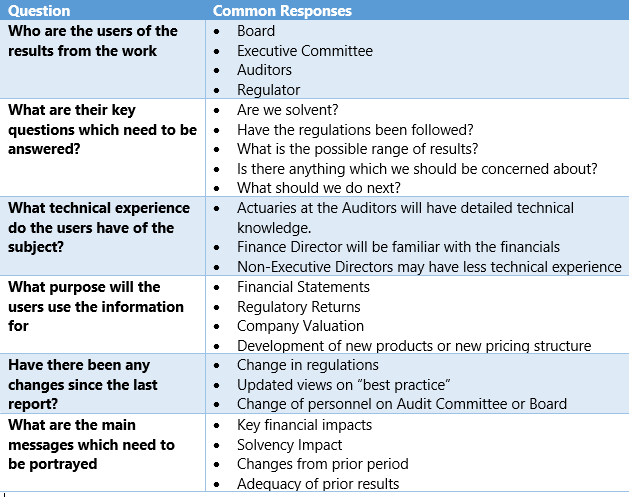

It is important to understand, before starting a piece of work, who the recipients are and what are their requirements. In many cases, there will be a number of different users, e.g. the regulator, the auditors and the Board, who may use the information in different ways. The actuary should be clear, at the outset, what information is required, by whom and how it will be used.

A key thing to keep in mind is not what you as the actuary want to tell your users, but what they want or need to hear and to understand.

Some useful questions to ask are set out in the table below.

Once you are clear on the user requirements, you can begin to scope out what is required from the work and how best to communicate the results.

Focus initially on the user requirements discussed rather than just meeting regulatory actuarial standards. This will lead to a report which engages the reader rather than one which could be considered as just ticking the regulatory boxes. Obviously, all reports need to comply with professional and regulatory standards such as the Technical Actuarial Standards (TASs) in the UK and the Solvency II Directive, but these requirements should be communicated in a way that makes sense to the users.

When scoping out the work, think about any discussions which occurred in previous years and any changes since the last investigation.

Read the other blogs in this series on Good Actuarial Reports.