The Good Actuarial Report Working Party has spent several years reflecting on and discussing how to make reports better. In our first blog in this series, we outline our proposed process and review what top-level questions need to be addressed.

The Good Actuarial Report Working Party has spent several years reflecting on and discussing how to make reports better. In our first blog in this series, we outline our proposed process and review what top-level questions need to be addressed.

A good actuarial report does not overwhelm its readers. They can trust what it contains and can readily find what they need. A good actuarial report is easy to understand and directly useful.

A poor actuarial report loses the reader in the first five minutes, overwhelming them with complexity and jargon or simply not directing them clearly to the point of the work.

How can actuaries maximise our chances of producing something good?

We have spent several years reflecting on and discussing how to make reports better and have scoured the literature for best practice, across a range of different professions and academia.

We haven’t found a silver bullet for report writing such as a generic template for all situations. However, we have developed a recommended process to help you think about and plan your report in the context of the whole piece of work you are undertaking, and most crucially in relation to what the users want or need from your work.

As with many things in life, the more you put in through planning and preparation for your reporting, the more you will get out in terms of reader engagement.

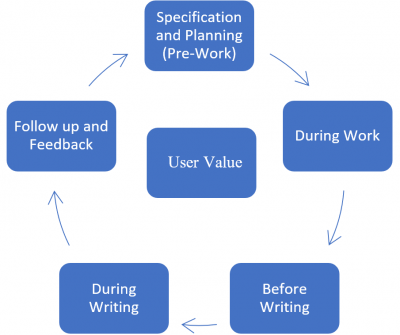

Our process is set out below, it’s no coincidence that it looks like an actuarial control cycle:

Resist the urge to just pick up your previous report and update it – start by asking yourself who are your report users and how well do you understand their expectations?

You know why your work is important and what value it’s adding – how can the work itself be done in a way that optimises user value and makes report writing easier?

Our work can be technically complex and often involves several different users - how can your report be structured achieve clarity?

It’s not what you say, it’s how you say it – how can style and graphical presentation be used to ensure your report is an engaging read?

A lot of our work comes around annually (or even more frequently) – how can you help users apply your results and get insights to improve the next report?

Further blogs are planned and will go into more details on each of these areas. You can find out more about who we are and our work by visiting the general insurance research working parties webpage.