Tom Kenny, Chair of the IFoA Social Care Working Party, explores the issues facing social care funding in the UK

Tom Kenny, Chair of the IFoA Social Care Working Party, explores the issues facing social care funding in the UK

What most people in the UK don’t realise is that social care is not free at the point of need, unlike healthcare. It can come as a real shock when people (or often their parents or dependents) need care, and the government doesn’t do enough to inform the public.

The general public need to be better informed about the way the social care system works, and the current options for self-funding and protecting against the risks, such as an immediate needs annuity or equity release mortgage.

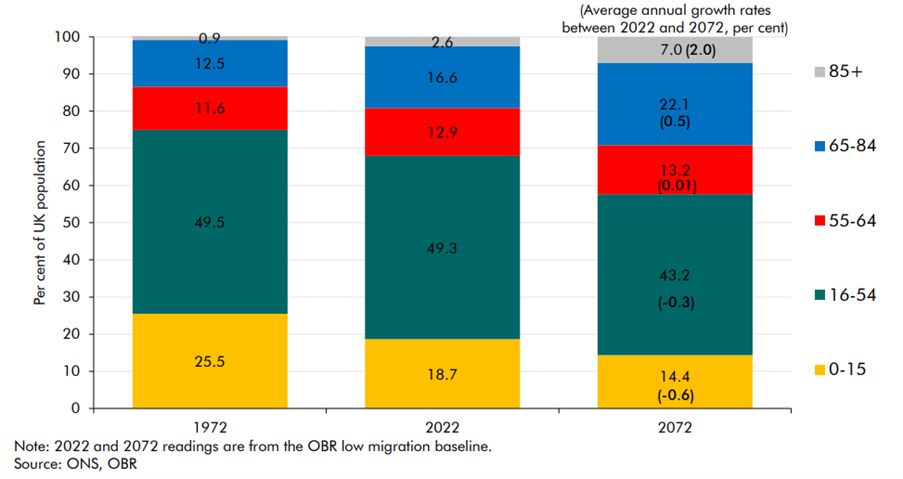

Policymakers in the UK need to think about the long-term interests of the country, rather than the short-term focus of policy measures to win the next election. Policymakers need to be upfront with the public about the long-term sustainability of the both pensions and the care funding system – particularly given the current fiscal constraints facing the government. The OBR made it clear in its 2022 fiscal sustainability report that based on the current population projections (a rapidly ageing society as shown below), either taxes need to rise by or spending needs to reduce by 10.8% of GDP. This compares to current social care spending of 1.2% of GDP, expected to increase to over 2.4% of GDP by 2070.

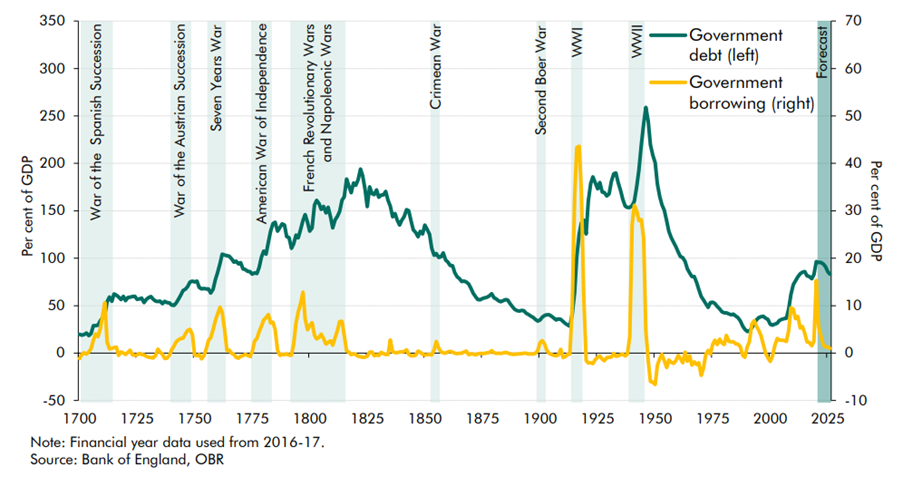

What’s the problem you might be asking? Well, the main issue is that social care and social security benefits are funded on a pay-as-you-go basis, from general taxation. This means that there are no reserves, such as a sovereign wealth fund, to meet future deficits, even though the OBR forecasts in 2022 estimated that government spending or taxation would need to change by 10.8% to have a long-term sustainable budget (based on the intertemporal budget).

In other words, the present value of future revenues is greater than or equal to the sum of existing debt and the present value of future government spending over an infinite horizon.

Solving the social care funding challenge is not easy – there are no ‘win-win’ options. While numerous recommendations were made by the Dilnot Commission in 2011, which were largely incorporated in the Care Act 2014, successive governments since then have failed to implement social care reform.

Given the continuous delays to implementing the care cap (a key recommendation from the Dilnot Commission), should the next government take a step back and consider if there is a more sustainable, fairer, and more progressive way to fund social care? Rather than implementing a cap that will add further complexity to an already complex system and put social services under further pressure, are there not better options?

Under a capped regime, it is also questionable if the insurance industry can offer insurance solutions to help close the funding gap if the general public do not understand the system and/or don’t want to spend their money on insurance for something they don’t think they will need…

This is discussed further in:

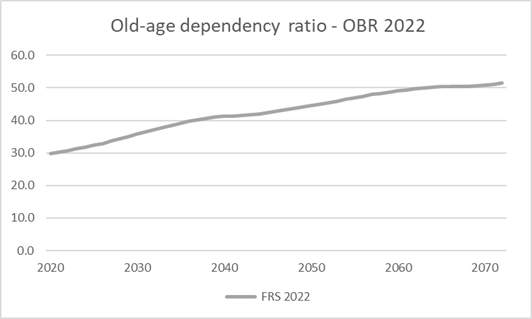

The rapidly ageing society introduces intergenerational issues with the current form of care funding. This means that the working population will spend an increasing proportion of their income on supporting the older population than previous generations.

One has to ask, is that fair and is it sustainable? At what point could it lead to a need to reduce state funded benefits to avoid a negative impact on the competitiveness of the UK economy?

The OBR estimates that the old age dependency ratio in the UK is expected to increase from 29% today to over 50% by 2070. All else being equal this could lead to spending on social care and social security increasing from 40% of income tax and National Insurance contributions today to about 65% by 2070.

There are numerous ways to create a sustainable social care funding system that are fair from an intergenerational perspective. The UK could learn lessons from how other countries such as Japan, Singapore, Germany, and France have tried to tackle the problem where social insurance schemes for social care have been implemented. For further discussion of this topic see: Age old questions – six countries’ differing approaches to social care | The Actuary

However, it is unlikely to be a means-tested system that has a cap on care costs, which is the current proposal for England from the Conservative and Labour parties.

The IFoA has been researching a number of long term policy issues which are summarised in its ‘Beyond the next Parliament’ report