Compared with other features of insurance underwriting, mental health is inadequately understood. It is a multifaceted and emotive topic that will require the combination of understanding, experience, and open collaboration to help millions of people. In this blog, Jon Loach sheds a little light on the work of the IFoA’s Mental Health Working Party.

Compared with other features of insurance underwriting, mental health is inadequately understood. It is a multifaceted and emotive topic that will require the combination of understanding, experience, and open collaboration to help millions of people. In this blog, Jon Loach sheds a little light on the work of the IFoA’s Mental Health Working Party.

The pandemic has shone a light on the importance of mental health and its impact on society. Additionally, employee well-being is an increasing feature of recruitment discussions and employee motivations. Although society’s understanding of mental health is improving, the insurance industry is lagging behind. For many individual products, underwriting processes – down to the way we ask questions – can seem to penalise people who disclose even mild or long-distant instances of mental health conditions. This is counterproductive as it:

Source: [Encouraging openness on mental health | The Actuary]

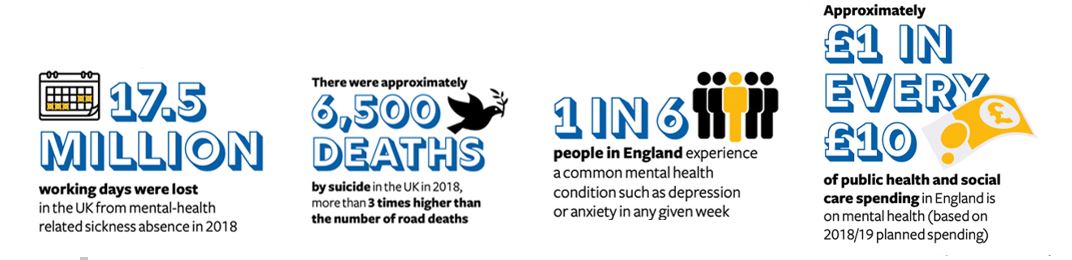

The statistics above show that this is significant issue and as actuaries design and price products that impact many people’s lives, we need to better understand them and their journeys to do this well.

Obvious associations with mental health and insurance might be self-harm, suicide or individual protection claims, but mental health has much wider actuarial implications. For example, in group income protection, work-related stress is a key driver of claims. Insurers have adopted strategies to proactively manage claims, including through the provision of cognitive behavioral therapy (CBT). Even for a product such as travel insurance, people with mental health conditions can find it hard to get coverage due to the potential costs of seeking support overseas.

Overall, the current approach is a vicious circle: it disincentivizes sharing information which would enrich the overall system.

The problem is multi-faceted but at the heart of the solution there are three key features:

In the next few months, we intend to share several blogs starting to address some of the many facets of this: e.g. the range of mental health conditions, the actual human experiences, results from the data analysis, the road map of the process in getting to insurance and a toolkit that draws on the experience gleaned from other industries. Every journey of a thousand miles…

Further information on this can be found in the Actuary’s August article by Lisa Balboa and Chris Knight – Encouraging openness on mental health | The Actuary