This op-ed is adapted from a paper, ‘The future of risk and insurability in the era of systemic disruption, unpredictability and artificial intelligence’, published in Journal of Operational Risk (Risk.Net) in June 2025.

This op-ed is adapted from a paper, ‘The future of risk and insurability in the era of systemic disruption, unpredictability and artificial intelligence’, published in Journal of Operational Risk (Risk.Net) in June 2025.

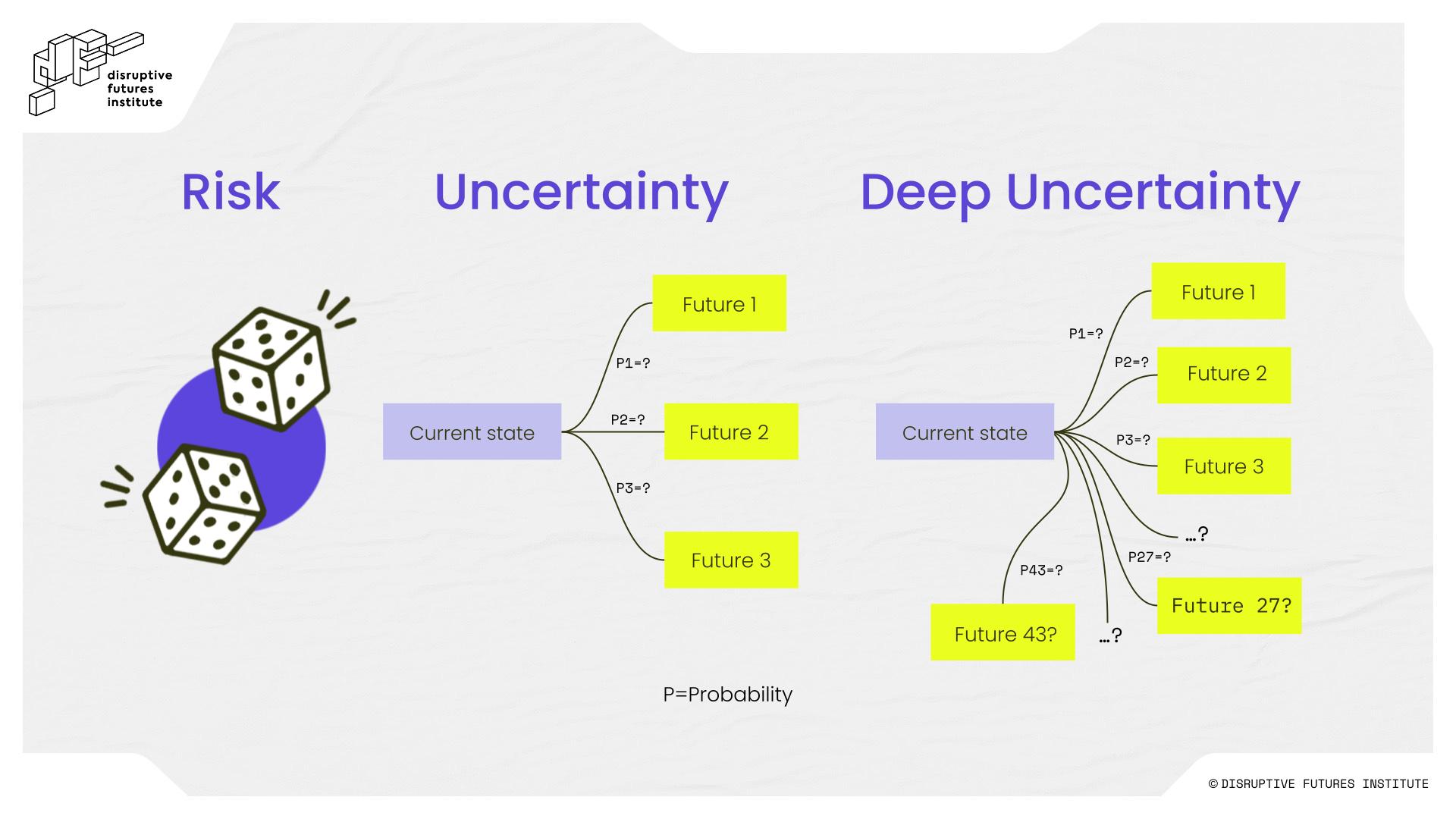

In 1921, economist Frank Knight drew a foundational distinction between risk and uncertainty. According to his writing in ‘Risk, Uncertainty, and Profit’, risk pertains to situations in which “the distribution of the outcome in a group of instances is known.” In contrast, uncertainty arises in contexts that are, to a significant extent, unique, making it difficult or impossible to assign probabilities to potential outcomes.

Around the same time, John Maynard Keynes similarly questioned the reliability of probabilistic reasoning in his ‘Treatise on Probability’. Both Knight and Keynes were responding to a growing realisation in early 20th century thought: not all future events are foreseeable, and not all uncertainty can be reduced to quantifiable risk.

So what happens when uncertainty cannot be quantified and outcomes unknown? Deep uncertainty – where even the nature or likelihood of future states is contested – emerges in nonlinear systems shaped by complexity, unknowability, and interdependent dynamics. In such environments, shocks can accelerate through feedback loops and cascade systemically.

Figure 1. Risk, uncertainty, deep uncertainty

Deep uncertainty is asymmetrical: shocks and disruptions propagate unevenly across sectors, geographies, and stakeholders, amplifying systemic fragilities. As unprecedented events grow more frequent, the shortcomings of traditional risk models become starker.

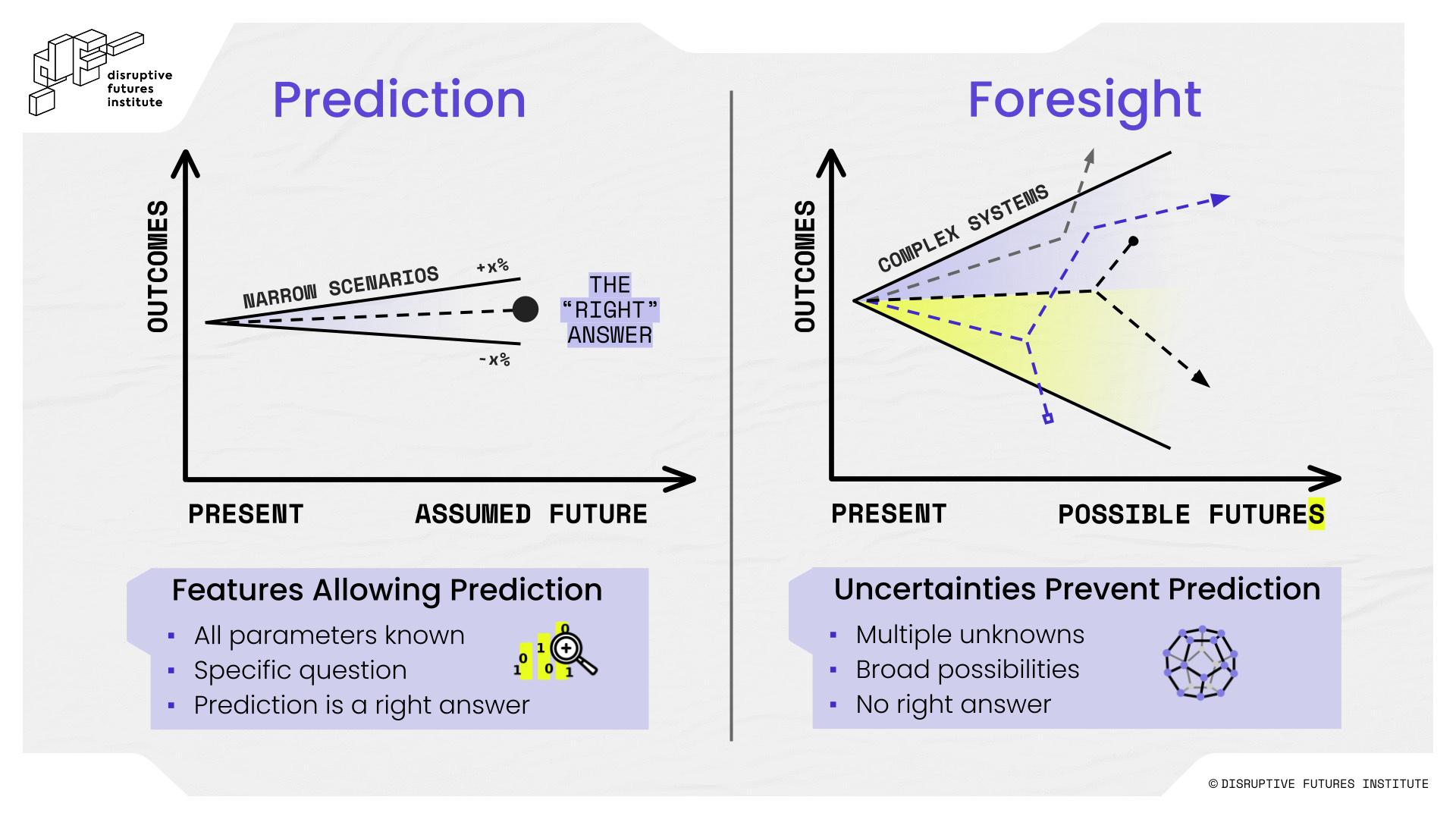

Financial models thrive on data to price risk and calculate returns, yet the world is throwing curveballs – climate shifts, geoeconomic shocks and all sorts of systemic disruptions – that defy historical patterns. Put simply, there is no data on the future.

This raises a hard question: Have our traditional ‘predict and act’ models, built on mountains of data, stopped working?

In June 2025, the Journal of Operational Risk (Risk.Net) published our paper ‘The future of risk and insurability in the era of systemic disruption, unpredictability and artificial intelligence’. Co-authored with Olivier Desbiey, Head of Foresight at AXA, the paper analyses the fragile nature of traditional risk management techniques in the face of frequent, high-impact shocks. We advocate for a new approach that treats disruption as systemic rather than episodic.

In an era defined by systemic disruption, radical unpredictability, and the rapid evolution of artificial intelligence, the classical distinction between risk and uncertainty – first articulated by Frank Knight and John Maynard Keynes – demands urgent reexamination.

Two key dynamics undermine predictability under conditions of deep uncertainty:

When parameters are known, we can venture into meaningful modelling and predictions. In deep uncertainty, countless, dynamic, and interacting unknown variables hinder predictability.

For instance, in 2022, even the US Treasury admitted to a fundamental lack of understanding regarding what it called ‘unanticipated’ economic shocks. Reflecting new levels of unpredictability, in 2025, officials at the Cleveland Fed shifted from relying on a single base case to considering a range of distinct scenarios. Data has failed to anticipate many of the most disruptive developments of recent years.

So if you can’t truly measure risk in future (or present) environments of deep uncertainty, would it be a far stretch to imagine resiliency-based insurance premiums?

Under systemic disruption, the most resilient insurance model isn’t is not about ‘predict and act.’ It’s evolving into ‘anticipate and prevent’ – and ultimately, to ‘imagine and empower’, as in hypothetical ex ante insurance models.

Figure 2. Prediction versus foresight

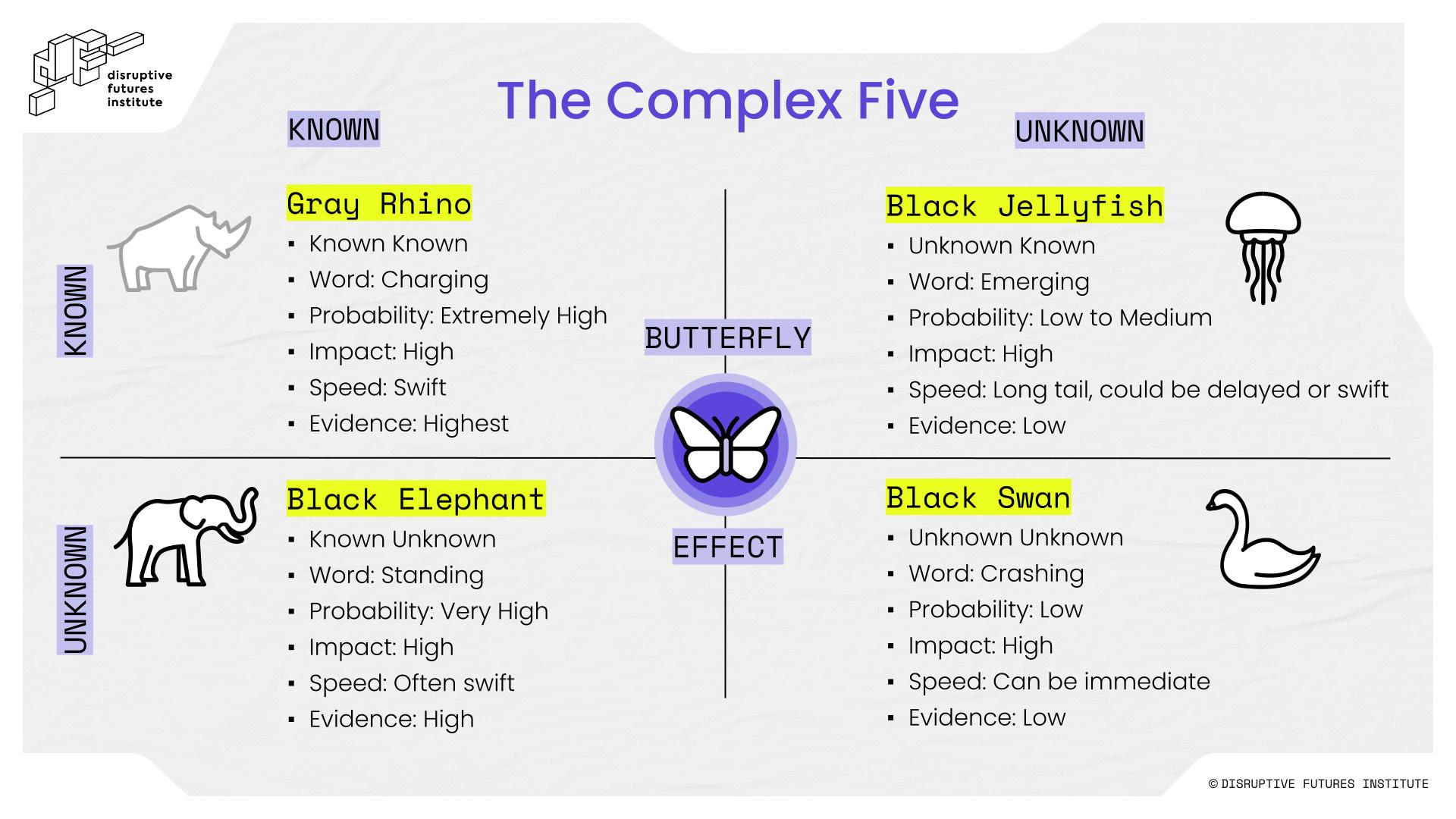

As famously articulated by former US Secretary of Defense Donald Rumsfeld, we constantly need to assess what is knowable (what could be known but is currently unknown) and what is unknowable (what cannot be known at all).

To address complex dynamic environments of deep uncertainty, we must recognise the different types of uncertainty. For this, we use our ‘Complex Five’ framework from the Disruptive Futures Institute:

Things we know that we know, like that the sun rises in the morning and sets at night. For these, we use Michele Wucker’s definition of ‘Gray Rhino’. There is no uncertainty with Gray Rhinos; we might treat them as unknown, but they are certain. To avoid being trampled, anticipate the impacts, rather than muddling along and panicking when the rhino charges.

Things we think we know, but we find that we don’t understand them when they manifest. For example, increasing ocean temperatures and acidity levels prompted perfect conditions for jellyfish population growth. This increase led to nuclear reactors around the world shutting down when jellyfish clogged their cooling systems.

Here, situations we believe we initially understand can become complex, as small changes drive larger, less predictable impacts. To describe such unknown knowns, Postnormal Times and Sardar and Sweeney use the term ‘Black Jellyfish’. To respond to Black Jellyfish, we need to consider snowballing effects by asking how these reverberations could cascade further.

Things we know we don’t know, including new diseases, impacts of climate change, and mass human migration. These are obvious, highly likely events, but few acknowledge them. We call these known unknowns ‘Black Elephants’ based on a term attributed to the Institute for Collapsonomics.

Addressing Black Elephants requires coordinated action, stakeholder alignment, and a systemic perspective attuned to complex interdependencies. In context-specific cases, proactive responses are essential. Failing to do so may allow Black Elephants to evolve into Gray Rhinos – visible, charging crises that can no longer be ignored.

Things that we don’t know that we don’t know. For these unpredictable outliers, we use Nassim Nicholas Taleb’s ‘Black Swans’. Responses to Black Swans include building resilient foundations and paying attention to rare events with profound impacts.

However unpredictable Black Swans are, we can still be anticipatory, while implementing guardrails for the randomness of our world. Look for the nonobvious. Accept randomness. Be aware of cognitive bias as the modern world becomes dominated by very rare events. When Black Swans appear, rise up from the devastation.

The flapping wings of one majestic insect brings these animals together. The ‘Butterfly Effect’, defined by meteorologist Edward Lorenz, describes how small changes can have significant and unpredictable consequences. To illustrate, Lorenz described a butterfly flapping its wings influencing tornado formation elsewhere.

Figure 3. The Complex Five

Phrases like ‘it has never happened before’ or ‘we have never seen this’ are not valid reasons to dismiss as possibilities. Events previously deemed ‘very unlikely’ are increasingly being reassessed as merely ‘unlikely’, or even, at times, ‘likely’.

Black Swans have become convenient justifications for C-suite executives and policymakers seeking to rationalise their surprise – surprise often rooted in flawed assumptions, ignored signals, or insufficient preparedness.

Ultimately, all such manifestations of uncertainty share a crucial commonality: ignorance, or a lack of evidence, does not constitute evidence of absence.

Today’s Complex Five landscape is defined by systemic disruption, degrees of profound unpredictability, and the accelerating influence of artificial intelligence. In this landscape, the future of risk and insurability confronts profound and unprecedented challenges.

To address the deep uncertainty inherent in such environments, we propose the ‘AAA Framework’: a synergistic approach encompassing ‘antifragile’, ‘anticipatory’, and ‘agility’ principles. Drawing on insights from complexity science, strategic foresight, and adaptive resilience, the framework emphasises imagination over prediction and prioritises managing the amplitude of outcomes over relying on probability.

By cultivating organisational shock absorbers and dynamic responsiveness, the AAA Framework empowers stakeholders to navigate volatility, build adaptive capability, and seize emergent opportunities across multiple plausible futures:

The AAA Framework supports decision-making under deep uncertainty (DMDU), resiliency, and future-preparedness.

Roger Spitz is a leading authority on systemic disruption and strategic foresight. Before founding the influential Disruptive Futures Institute in San Francisco, he served as Global Head of Technology M&A at BNP Paribas, advising on over $25 billion in transactions.

Spitz is an expert advisor to the World Economic Forum’s Global Foresight Network. As President of Techistential, the preeminent foresight practice, Spitz advises CEOs, boards, and investors on strategy under uncertainty, anticipating disruptions, and sustainable value creation.

Recipient of the Top Voice Award 2025 as the most influential futurist shaping business, technology, and innovation, and ranked among the Top 10 global thinkers in management and leadership (Thinkers360), Roger Spitz coined the term ‘Techistentialism’ and is widely recognised for his seminal insights on the future of AI and strategic decision-making.

Spitz serves on multiple boards, and is a bestselling author of five books, including the award-winning ‘Disrupt With Impact: Achieve Business Success in an Unpredictable World’ and acclaimed four-volume series ‘The Definitive Guide to Thriving on Disruption’. Spitz’s frameworks are adopted globally and feature in leading publications.

His recent paper challenges the legacy risk models: The future of risk and insurability in the era of systemic disruption, unpredictability and artificial intelligence | Journal of Operational Risk (Risk.Net)